Court Says Media Outlets Defamed Conservative Economist, Orders Them To Pay Massive Settlement.

The IRS targeted economist Peter Schiff for tax evasion, and found nothing.

An Australian judge is ordering two media outlets to pay American economist Peter Schiff more than half a million dollars for defaming him.

It’s the latest fallout in a bizarre scandal in which the IRS and the governments of five other countries joined together to target Schiff, a frequent guest on conservative media, with the “biggest tax evasion investigation in the world.”

Despite poring over every detail of a bank he ran in Puerto Rico, authorities failed to come up with a single charge. But government agents apparently leaked the existence of the investigation to the New York Times and Australian media outlets The Age and 60 Minutes, both of which are owned by Australian media giant Nine. The journalists took Schiff’s advocacy for low-tax policies as evidence that he would break existing tax law.

The media reporting on the unfounded investigation led to a series of calamities for the bank, culminating in it being shuttered by a Puerto Rican regulator — with the IRS falsely taking credit for the closure and suggesting it was because of money laundering and tax evasion, even though its investigation substantiated neither of the charges.

Tax agents appeared to work closely with the media on that infamous press conference. The New York Times learned that the bank was being shuttered, purportedly because of the criminal probe dubbed “Operation Atlantis,” before Schiff did.

Officials may have violated the law by disclosing the existence of a grand jury to reporters. But with little recourse against the U.S. government, Schiff sued the journalists who seemed to be in cahoots with the agents in Australian court.

He named The Age, 60 Minutes, as well as two reporters — Charlotte Grieve and Nick McKenzie — who worked on an over-the-top video segment as well as an article. An Australian judge ruled that the television segment was defamatory, but the article was not.

The Australian journalists strongly suggested that Schiff was guilty of money laundering and tax evasion crimes, and that the case showed the need for more financial regulation. The story came as some Australian politicos were pushing a law that would give the government new powers to monitor people’s money — Schiff was made to be the poster-child villain.

Discovery in the lawsuit gave insight into the inner workings of major media outlets and suggested that they were determined to make Schiff’s bank, Euro Pacific, play such a narrative role. Interview notes and transcripts showed that their own sources often told them that Schiff’s bank was rigorously compliant. Then they used fast-cut editing to give the impression the witnesses said the opposite.

The Australian 60 Minutes segment suggested that Schiff’s Euro Pacific Bank opened accounts for money launderers, tax evaders, and criminals, and that it was attractive because it did little to vet its clients. But when Grieve asked one confidential source, a former customer, what opening an account was like, he said “it took weeks and weeks and weeks.”

“They were just so careful about making sure who they were dealing with, I’ve never come across anything like it,” the source said, according to interview notes disclosed in a court filing.

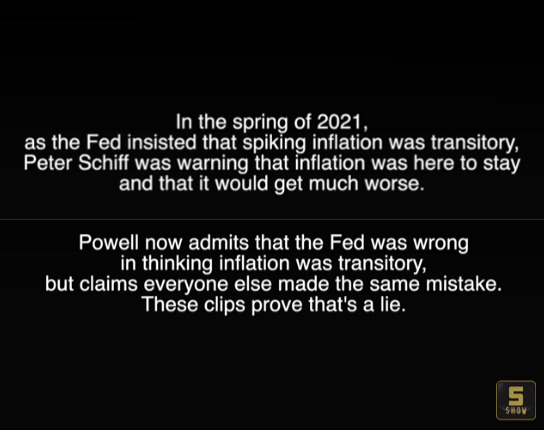

Peter Schiff and Tucker Carlson Were Right on Inflation

https://www.youtube.com/watch?v=PWoKAfMJhiY&t=269s

Read much, much more at the link:

https://www.dailywire.com/news/court-says-media-outlets-defamed-conservative-economist-orders-them-to-pay-massive-settlement